Child Tax Credit Increase 2024 Limits Irs

Child Tax Credit Increase 2024 Limits Irs – Here’s why you may want to wait to file your federal tax return if you’re claiming the child tax credit this year. . The House of Representatives voted Wednesday to approve a roughly $80 billion deal to expand the federal child tax credit that would make the program more generous, primarily for low-income parents, .

Child Tax Credit Increase 2024 Limits Irs

Source : www.forbes.comHere Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.comHere Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.comIRS Announces 2024 Tax Brackets, Standard Deductions And Other

USA Child Tax Credit 2024 Increase From $1600 To $2000? Apply

Source : cwccareers.inIRS Announces 2024 Tax Brackets, Standard Deductions And Other

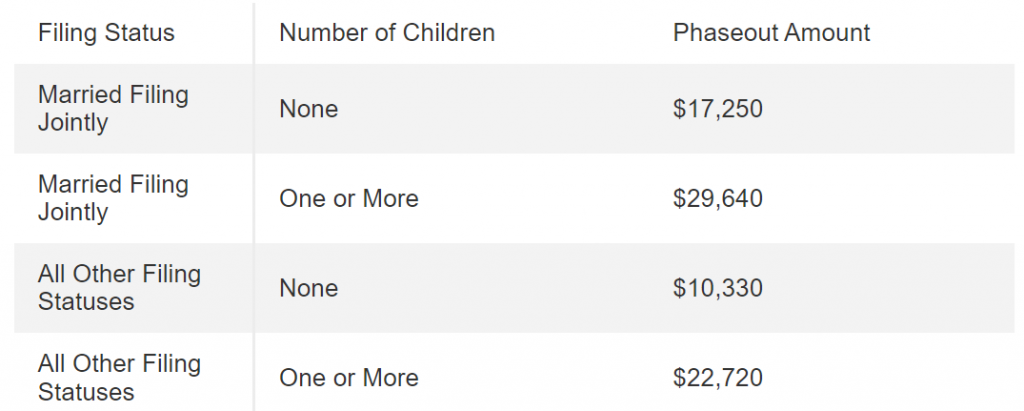

Source : www.forbes.comMaximum Earned Income Tax Credit for 2024 #eitc #credit #irs #2024

Source : www.tiktok.comYour First Look At 2024 Tax Rates: Projected Brackets, Standard

Source : www.forbes.com401K Contribution Limits 2024: What are the 401K Contribution

Source : www.incometaxgujarat.orgChild Tax Credit Increase 2024 Limits Irs IRS Announces 2024 Tax Brackets, Standard Deductions And Other : An expanded child tax credit would significantly increase the child tax credit for lower-income families with multiple children. . In 2022, the Child Tax Credit reverted to its former setup, so to speak. The maximum value of the credit was restored to $2,000 per child, and only a portion of the credit remained refundable. That’s .

]]>